lowest sales tax in orange county california

Prices are up 9 over 12 months. This is the total of state and county sales tax rates.

Solar Panel Cost In Orange County Ca 2022 Guide Energysage

The current total local sales tax rate in Orange County CA is 7750.

. In the state of California the sales tax is calculated for where you register the vehicle not where you buy it. What is the sales tax rate in Orange County. Only about a quarter of the cities in California actually charge a sales tax of 725.

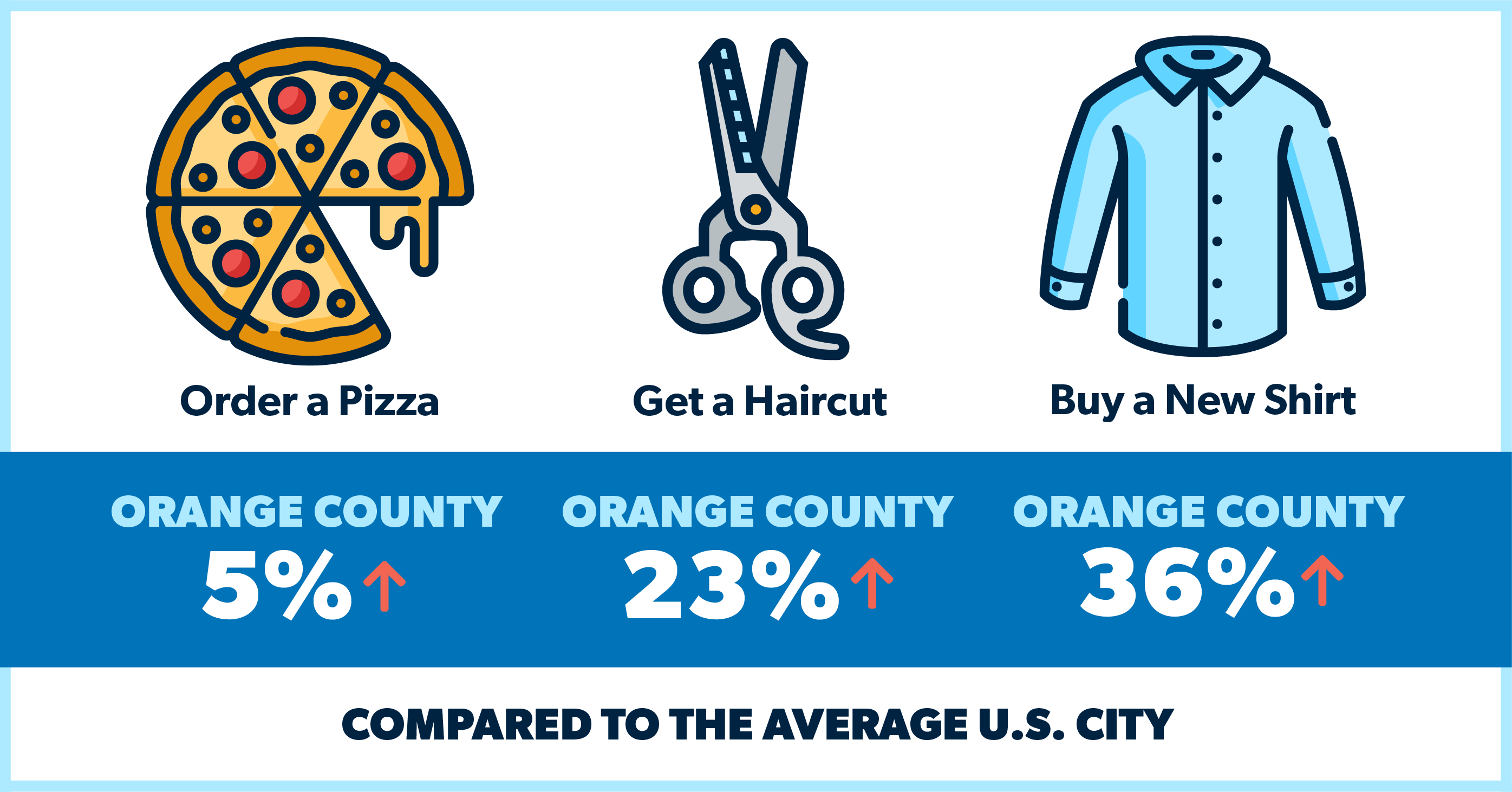

California has 2558 cities counties and special districts that collect a local sales tax in addition to the California state sales taxClick any locality for a full breakdown of local property taxes. Putting everything together the average. The average cumulative sales tax rate in Orange County California is 823 with a range that spans from 775 to 1025.

August sales were the slowest for any August in 35 years. The minimum combined sales tax rate is 775 for the year 2022 in Orange County. This is the figure consisting of state and municipal taxes of which 6 of the Sales Tax.

The base level state sales tax rate in the state of California is 6. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales. For in person tax sales payment must be made in cash US currency only limited to 10000 or a state or federally chartered bank-issued cashiers check made payable to the County of.

A county-wide sales tax rate of 025 is applicable to localities in San Diego County in addition to the 6 California sales tax. This includes the rates on the state county city and special. 1788 rows California City County Sales Use Tax Rates effective October 1.

Los Angeles sales tax. Download all California sales tax rates by zip code. The state then requires an additional sales tax of 125 to pay for county and city funds.

Orange County sales tax on cars. Additional sales tax is then added on depending on location by local government. The December 2020 total local sales tax rate was also 7750.

Orange County in California has a tax rate of 775 for 2023 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025. On top of the states minimum sales tax individual counties and cities also charge a sales tax. The minimum combined 2022 sales tax rate for Orange County California is.

Cities andor municipalities of California are allowed to collect their own rate that can. The statewide tax rate is 725. 4412 payment on the 984000 median up 1417 or 47.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Orange County Vs Los Angeles Comparison Pros Cons Which Is Better For You

Orange Ca Mobile Manufactured Homes For Sale Realtor Com

Orange County Ca Businesses For Sale Bizbuysell

Cost Of Living In California Ramsey

When Government Fails The Orange County Bankruptcy Baldassare Mark 9780520214866 Amazon Com Books

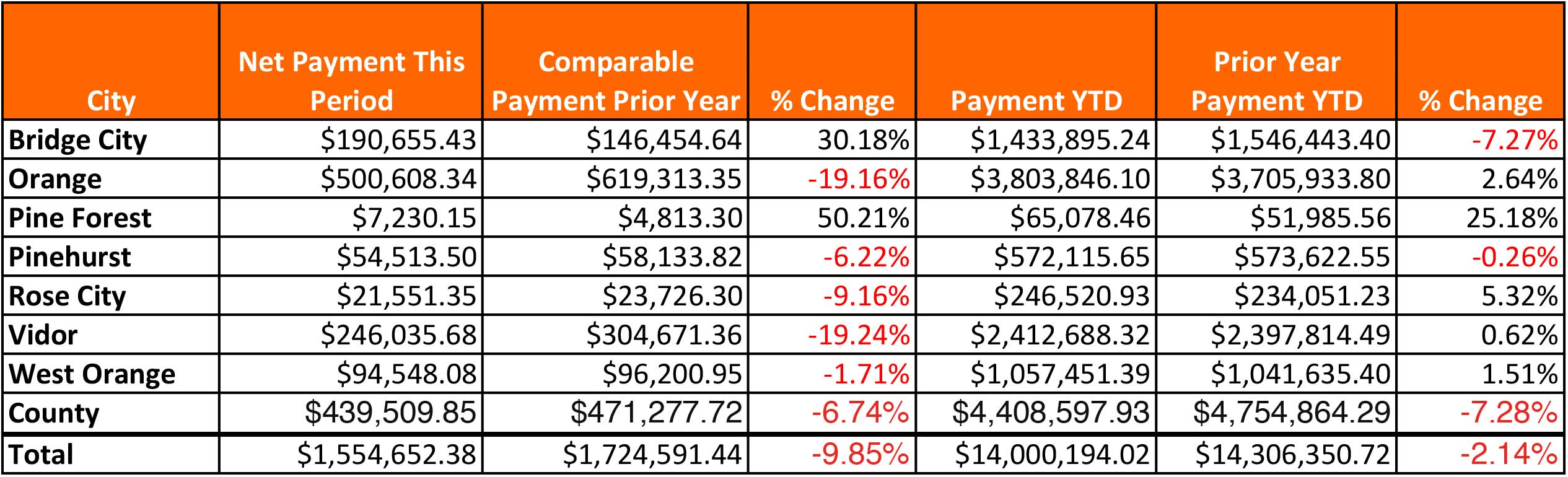

Sales Tax Down For Most Of Orange County Orange Leader Orange Leader

California Housing Market Dismal Sales Prices Sag In San Francisco 20 Fr Peak Silicon Valley San Diego Orange County Wolf Street

Orange County Ca Property Tax Calculator Smartasset

Complete List Of Tax Deed States

Why Did One Of Orange County S Most Park Poor Cities Quietly Sell Off A Slice Of Its Own Public Park

California Sales Tax Rate By County R Bayarea

Orange County S Hot Housing Market

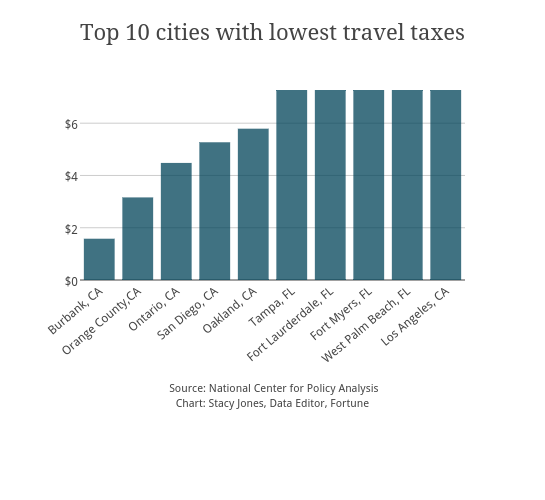

Florida Sales Tax Rates By City County 2022

Jonathan Lansner Orange County Register

Refundable Credit Would Ease Food Sales Tax For Low Income Kansans Kansas Action For Children

What Is It Like To Takeoff From John Wayne Airport In Orange County Ca Quora